TORONTO, July 24, 2025 – Hamilton Capital Partners Inc. (“Hamilton ETFs”) is pleased to announce the upcoming monthly and semi-monthly cash distributions for its ETFs. Distributions may vary from period ...

Yield Maximizer™ ETFs

More income, every month

Sectors

- REITs Yield Maximizer™ RMAX

- Canadian Financials Yield Maximizer™ HMAX

- Utilties Yield Maximizer™ UMAX

- U.S. Equity Yield Maximizer™ SMAX

- Technology Yield Maximizer™ QMAX

- U.S. Financials Yield Maximizer™ FMAX

- Healthcare Yield Maximizer™ LMAX

- Energy Yield Maximizer™ EMAX

- Gold Producer Yield Maximizer™ AMAX

Enhanced ETFs

Growth & Income that works harder

Multi-Sectors Covered Call

Hamilton Champions™ ETFs

Built from proven performers

Dividend Champions

Financial Sector ETFs

Smart options from banks & financials

Canadian Banks & Financials

Global Banks & Financials

Yield Maximizer™ ETFs

More income, every month

Sectors

- REITs Yield Maximizer™ RMAX

- Canadian Financials Yield Maximizer™ HMAX

- Utilties Yield Maximizer™ UMAX

- U.S. Equity Yield Maximizer™ SMAX

- Technology Yield Maximizer™ QMAX

- U.S. Financials Yield Maximizer™ FMAX

- Healthcare Yield Maximizer™ LMAX

- Energy Yield Maximizer™ EMAX

- Gold Producer Yield Maximizer™ AMAX

Enhanced ETFs

Growth & Income that works harder

Multi-Sectors Covered Call

Hamilton Champions™ ETFs

Built from proven performers

Dividend Champions

Financial Sector ETFs

Smart options from banks & financials

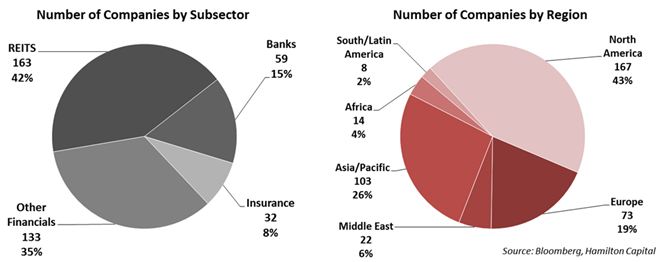

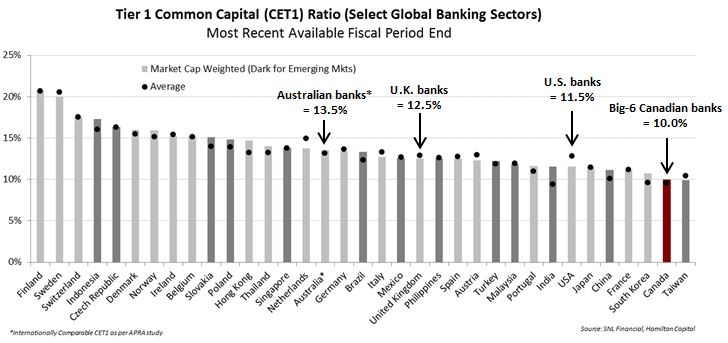

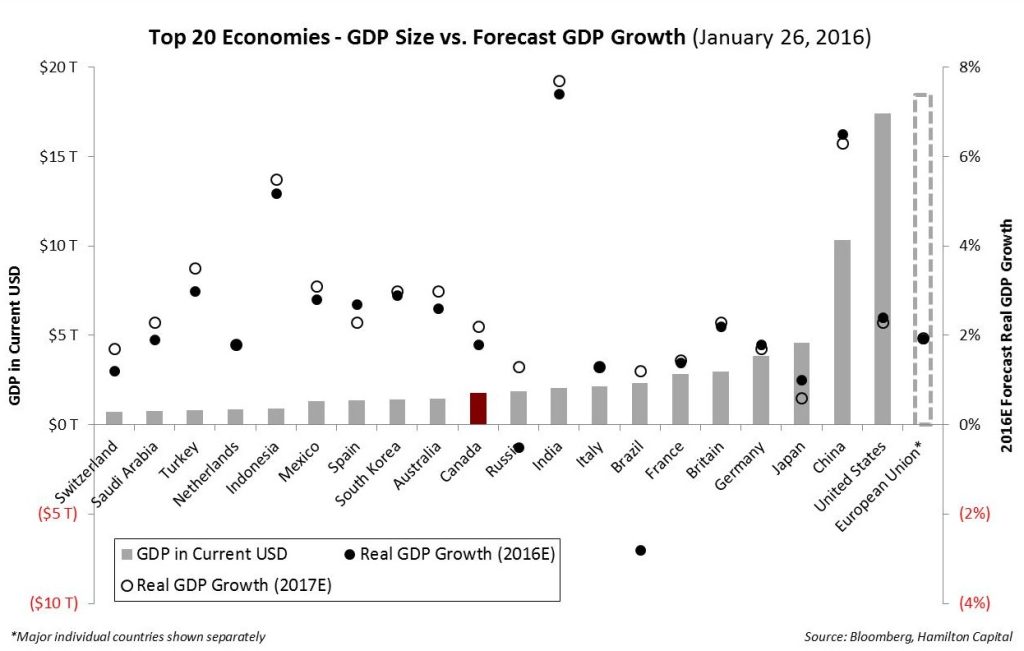

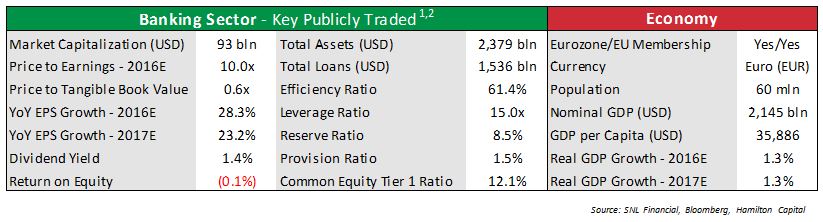

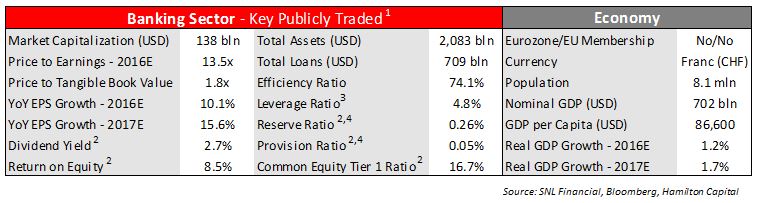

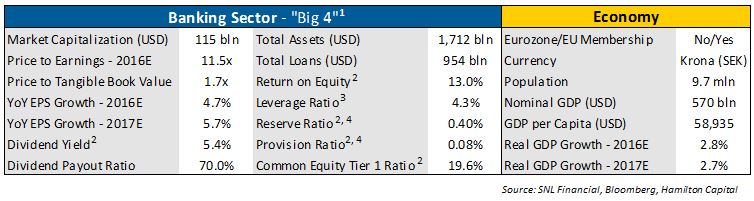

Indian Banks Overview: Large Diverse Sector, Operating in a High Growth Market

In this insight, we provide a review of the Indian economy and banking system, highlighting the most important issues facing the sector. India is a large emerging market with a ...