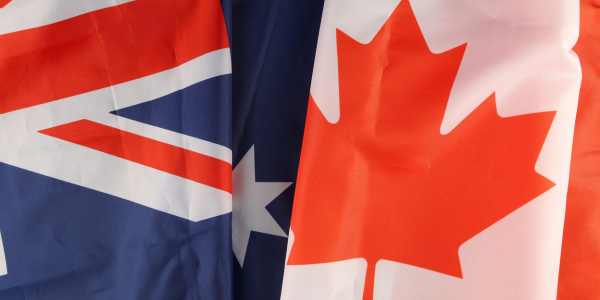

It is well known that Canadian investors favour their domestic banking oligopoly for its history of solid growth and stable dividends. What is less well known is that Australia is ...

Hamilton Champions™ ETFs

Built from proven performers

Dividend Champions

Financial Sector ETFs

Smart options from banks & financials

Canadian Banks & Financials

Global Banks & Financials

Yield Maximizer™ ETFs

More income, every month

Sectors

Fixed Incomes

Enhanced ETFs

Growth & Income that works harder

Fixed Incomes

Sectors

Multi-Sectors Covered Call

Hamilton Champions™ ETFs

Built from proven performers

Dividend Champions

Financial Sector ETFs

Smart options from banks & financials